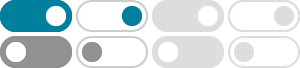

ROLLOVER CHART ... 1Qualified plans include, for example, profit-sharing, 401(k), money purchase, and defined benefit plans. 2 Only one rollover in any 12-month period. 3Must …

Rollovers of retirement plan and IRA distributions

Find out how and when to roll over your retirement plan or IRA to another retirement plan or IRA. Review a chart of allowable rollover transactions.

Individual retirement arrangements (IRAs) - Internal Revenue Service

Jul 30, 2025 · Rollovers (See our rollover chart PDF) The why, what, how, when and where about moving your retirement savings. FAQs: Waivers of the 60-day rollover requirement YouTube …

Publication 590-A (2025), Contributions to Individual Retirement ...

Rollovers Generally, a rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan within 60 days you received the …

Verifying rollover contributions to plans - Internal Revenue Service

Feb 26, 2025 · Example 1: Alice makes a direct rollover contribution to Plan A with a check from Plan B payable to the trustee of Plan A, for the benefit of Alice. Plan A accepts all rollover …

Rollovers of after-tax contributions in retirement plans

You may request: A direct rollover of $80,000 in pretax amounts to a traditional (non-Roth) IRA or a pretax account in another plan, A direct rollover of $10,000 in after-tax amounts to a Roth …

Topic no. 413, Rollovers from retirement plans - Internal Revenue …

1 day ago · A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan.

Resources — IRA-based plans - Internal Revenue Service

Nov 16, 2025 · Rollover Chart PDF A Rollover Chart summarizing the rollover rules is provided as a general guide but should not be relied upon as a substitute for professional tax advice.

For each conversion or rollover, you must first allocate the early distribution to the portion that was subject to tax in the year of the conversion or rollover, and then to the portion that wasn’t …

Retirement topics - Exceptions to tax on early distributions

Dec 31, 2023 · Distributions from a governmental 457 (b) plan are not subject to the 10% additional tax except for distributions attributable to rollovers from another type of plan or IRA.